|

Oracle HTTP Server 12c is based on the proven, open source Apache HTTP Server technology and provides the framework for hosting static, dynamic web pages and for front-ending Oracle Fusion Middleware Applications.

Features

Content Serving / Reverse Proxy

Cloud Deployment / Virtual Server Support

Thousands of sites / application domains served from a single web server instance. Each virtual server can have its own configuration files, IP addresses, port, document root, preferences, log files, and more. Protection From Common Threats

Built-in ModSecurity module provides the ability to configure rules to introspect and protect applications from common attacks including SQL/Command injection, Cross Site Scripting vulnerabilities and other vulnerabilities. FastCGI Support

Efficient way to serve dynamic content web pages within OHS by using scripting languages such as PHP or Python, without incurring a significant performance penalty. Integrated Reverse Proxy

Built-in proxy modules provide generic proxy support as well as optimized support for WebLogic Server, allowing OHS to act as the HTTP end-point for HTTP origin servers including WebLogic Server. | Administration / Monitoring

Server Administration

Leverages WebLogic 12c administration interfaces to provide a simple, consistent and distributed administration model for administering Oracle HTTP Server, Oracle WebLogic Server and the rest of the Fusion Middleware Stack.

For more information, please refer to Understanding the OHS Administration Model section.

Monitoring

Integration with Oracle Enterprise Manager allows customers to monitor HTTP traffic by using the Oracle Enterprise Management console.

Robust Migration Tool

Integrated migration tools make it easy to migrate existing Oracle HTTP Server 11g deployments to Oracle HTTP Server 12c. |

Documentation and Useful Links Product Documentation contains Release Notes, Installation and Administration guides.

|

How To Delete A Upi Id

Copyright © 2017, Oracle and/or its affiliates. All rights reserved. |

Primary Bank For Upi Id Cannot Be Deleted Password

App Download:

Download PNB UPI App from Google Play Store.User Registration:

Tap CLICK ME to verify your mobile number. An SMS will be sent from your mobile for verification. The SMS should be sent from the mobile number registered with the bank accounts.After your mobile number is verified, the NEW REGISTRATION screen is displayed. Fill in the required details.Create six digits numeric password for logging in to application and confirm the same. On successful registration, you will be redirected to DASHBOARD . Add Bank A/c :

Click on Add bank A/c, a LIST OF BANKS which are registered with UPI will be displayed Select your bank, all accounts of the bank which are linked to your registered mobile number would be displayed. Select the desired bank account and press Submit You can add more than one bank accounts on the same app You can also add bank acocunts of banks other than PNB if the banks are registered with UPI and are linked to the same mobile numberSet PIN:

Click on Set PIN and select the added bank account To GENERATE PIN, enter the OTP delivered to the registered mobile number. Set a 6-digit PIN and confirm the same. Enter the last 6 digit of the debit card linked to your account and enter its validity. Click on Submit, use this PIN for authorizing all the transactions. Add Virtual Address:

Virtual Address is a unique identifier which will be used for performing funds transfer. The use of viryual address keeps your bank details confidential. The virtual address is mapped to a bank account. Virtual address should be of minimum 3 characters and can be alpha-numeric and is case-sensitive. For example: xyz@pnb For creating a virtual address, choose your REGISTERED BANK ACCOUNT Create a VIRTUAL ADDRESS, you can create multiple Virtual Addresses for a given bank account.Optionally, you can set the frequency of use, limits for time and amount. Manage A/c:

You can MANAGE YOUR ACCOUNT i.e., you can view the registered bank accounts. You can modify the limits associated with the virtual address linked to your accounts. You can also delete the associated Virtual Addresses View Balance:

You can view your account balance by using your PIN. Choose the REGISTERED BANK ACCOUNT Enter the 6-digit PIN to view the balance. Participants:

For the frequently used beneficiaries, you can save the details in the Participants. You can add participants through following ways: 1. Virtual Address.

2. Account Number + IFSC.

Click on PARTICIPANTS and Select Payment Address Type to view the added participants Click on + symbol to add new participant. To REGISTER A CONTACT, select the Payment Address Type and enter the valid beneficiary details. Pay:

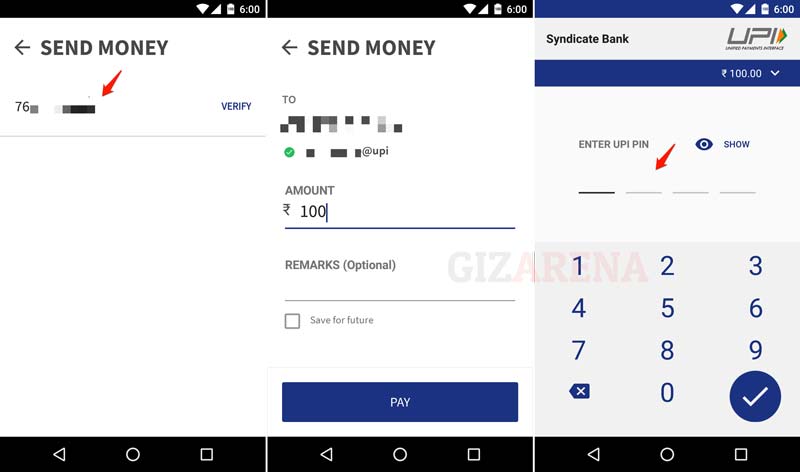

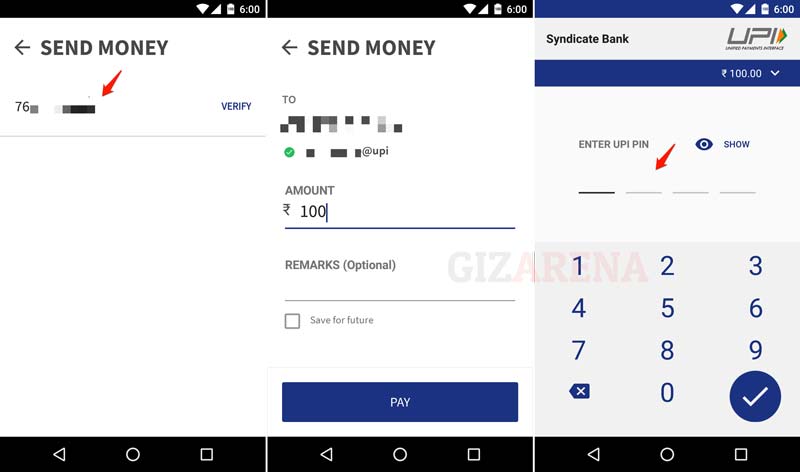

You can transfer funds from your account to any Indian account by using either the Virtual Address or the IFSC Code and Account number of the beneficiary.To SEND MONEY, choose your bank account, select the payee Address type, enter the beneficiary details, (you can choose the beneficiary from Participants or enter the details). Enter the amount and click Submit. CONFIRM the entered details, enetr the transaction PIN to authorize the transactionCollect:

You can request funds from any person registered on any UPI appClick on COLLECT, enter the details of the payer. Choose the expiry date and time of transaction. Click Submit. CONFIRM the details to send the request to the payer. The payer would be notified via SMS and notification in the app You can track your request through Txn Status. Change PIN:

Here, You can CHANGE your transaction PIN.Enter your old PIN. Enter the new PIN and confirm the same. Pending Approval:

If any UPI user has requested you for the funds, you can see those requests under Pending Approval.Click on the request and verify the details. Enter the PIN to authorize payment Txn Status:

Here, You can check transaction status for both collect request and send money requests for a given range of date. To report any discrepancy/grievance, click on the transaction, enter the comments, and press Log A Complaint Complaint Status:

Here you can view the status of complaints lodged.Banks, Bank Branch, and Bank Accounts Window References Banks Window References. Bank Information Region. Bank Name: The name of the bank. Short Bank Name: This may be an alpha or a numeric reference. Country: The name of the country where the bank is located. Alternate Name: You can enter an alternate name for your bank. This is particularly. How to delete Bank Account Linked To Paytm UPI On paytm app – use this bank account to send and receive money – delete this bank option shows but if we click and select Ok then the bank option does not get deleted any other way to do it. I have users table in my PostgreSQL 9.3.6 database with two columns: id and anotherid. The id is a primary key, the anotherid is just another integer column with unique constraint.

Primary Bank For Upi Id Cannot Be Deleted Messages

Against his / her bank account(s). “UPI PIN” means a four or a six-digit numeric PIN used for authenticating services provided under UPI. In case of Citibank users using UPI on 3rd Party Apps, other than the Citi Mobile App, the UPI PIN will be the ATM PIN of the primary debit card of the account registered for UPI.